There is much talk about the Lenskart IPO, it’s valuation and people who are investing in it.

Recently, a mutual fund house called DSP Mutual Funds even tweeted their rationale for investing into Lenskart IPO.

One of the fund Managers at DSP – Sahil Kapoor is a well respected fund manager even among the professional investors community.

What you think of any Mutual Fund company’s decision to invest in such a valuation scenario is a personal matter.

But there is a even deeper problem at play here.

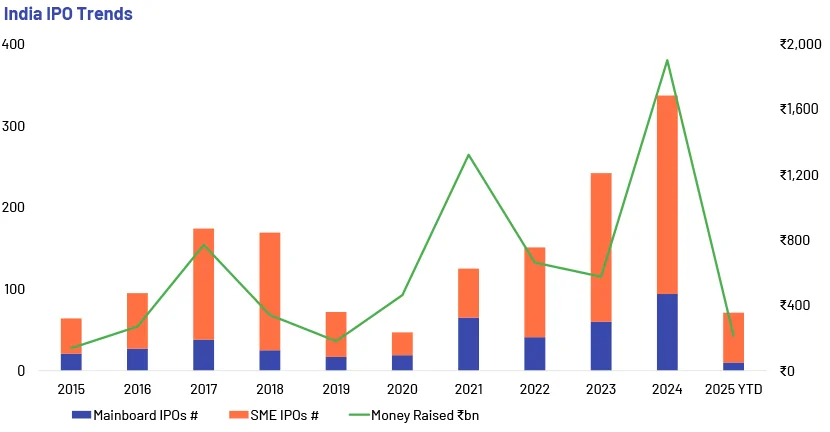

We already know that since the covid-19 pandemic, there has been a outburst in the growth of SME IPO’s for the last 5 years.

We also know that these most of these SME companies are declaring fake numbers and even faker stories to create a sense of euphoria around the future prospects of their company.

Let us dig into one such stories where “I think” we the people should give more attention and create public outcry for:

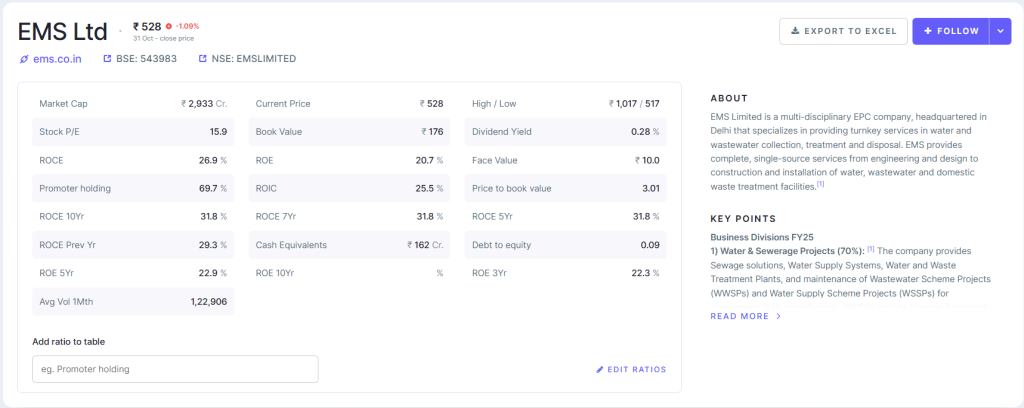

There is a listed company called EMS Ltd.

The reported numbers are so good, even the most conservative filters will lead you to this company.

So I decided to dig in:

(All I had to do was give a visit to the ValuePickr forum’s EMS Page)

User Pankaj Motwani shared this stuff on the ValuePickr forum:

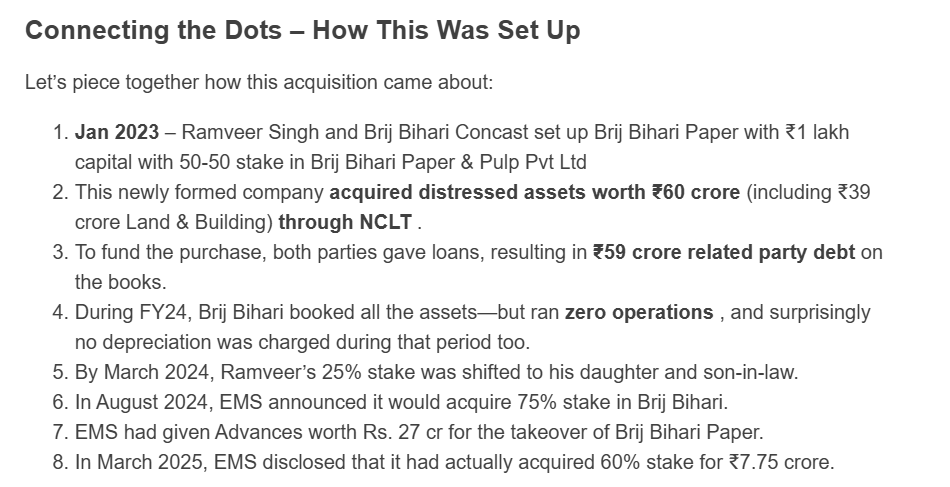

EMS Ltd got listed on 23rd September 2023.

Prior to that, in January, the promoters had setup another Pvt. Ltd company and had used it to purchase some Land, Building and Machinery.

And then EMS Ltd was acquiring this Pvt Ltd. using money they collected through the IPO.

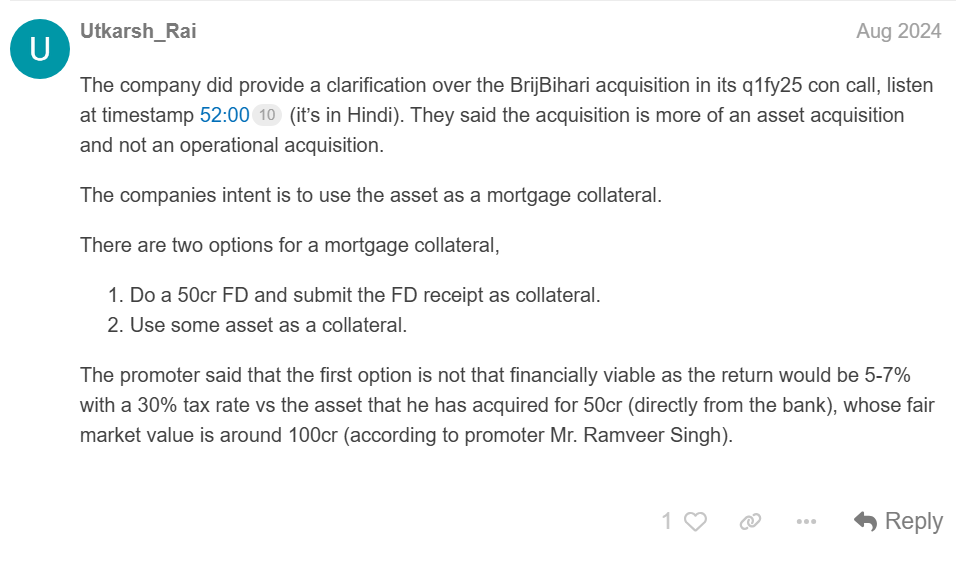

When people asked EMS Ltd on ConCall for reasons for acquiring this Pvt Ltd company, here is what they told as the reason:

“They wanted to use the Land, Building and Machinery Assets of the company as Collateral for Loans”

Now everyone in business agrees that using Loans or the Overdraft Facility for Working Capital is much better than keeping the whole amount in your Current Account(without earning any interest).

Read more about it here: (How to make your money work for you?)

But it is my opinion that, no one goes through the hassle of incorporating a Private Limited Company to buy Assets which can be later acquired by another of your Entity with IPO money. So that you can use it as collateral for loan for your working capital requirements.

By now, you might have started thinking:

“Okay, this might be shady company. Why are you telling me about it?”

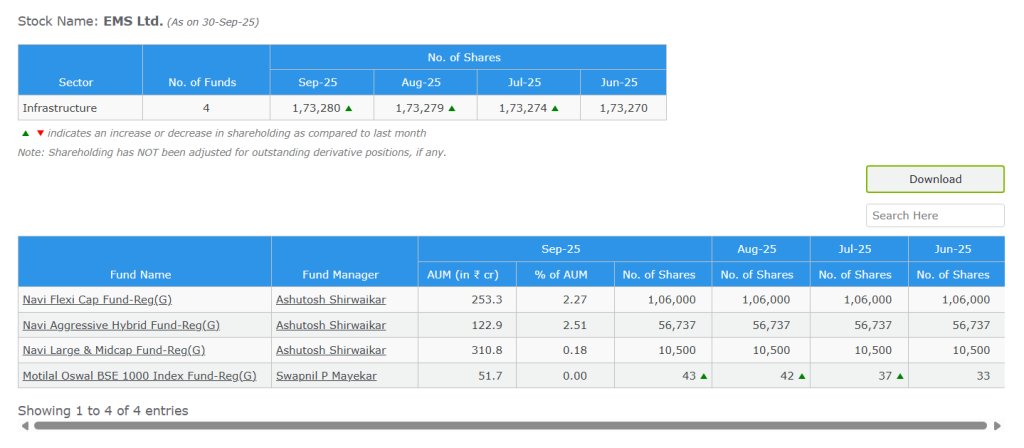

Okay, so now let us look at which mutual fund houses have a stake in this company:

We can’t blame Motilal Oswal for investing in this, because they are following the Index. It is an index fund. And they have bought a total of 43 shares. That’s about 26,000 Rs against the total fund size of 51 crores. It’s almost non existent.

But look at Navi Mutual Fund:

It holds nearly ~1,72,000 shares. Which is more than ~ 9 crore Rupees.

Even 9 crore is a very small number compared to the total Indian Mutual Fund AUM size which is ~75,00,000 crores.

Still, 9 crore is very big number for any individual Indian.

Who has given Navi Mutual Fund the authority to invest in such companies?

What research have they done before putting people’s hard earned money into this?

Is there any public accountability by SEBI which allows for the IPO of such companies or by SEBI which allows NAVI Mutual Fund to invest in such companies or by AMFI who allow distributors to sell the funds of NAVI in the lure of high commissions?

What happens when such a company goes bust?

- Promoters got their IPO money.

- Fund Managers got their fat salaries.

- Distributors got their fat commissions.

- Only the poor investor has to face the loss.

I know this is the free market. I know this is capitalism. I know there is freedom.

But then why create a fake sense of regulation and safety around the Mutual Fund Industry. And why spend the public money on institutions like SEBI, to create a fake sense of regulation?

It is a discussion, not a verdict, so please put your points of view in the comments section below: