Human beings are a product of their habits and base instincts and their surroundings and not a product of their decisions (which they most likely fail to implement).

Qualities of a Great Investor

Supplier of liquidity in bad times when no one wants to own risky assets like Equities.

And supplier of Sanity and rational thought in crazy times when everyone thinks Equities are as safe as Fixed Deposits or Government Bonds.

Qualities of a Great Financial Advisor.

Being a financial advisor does not automatically mean that you have tons of money, so being a supplier of liquidity can be a difficult pursuit.

But if we think financial advisors act through their clients, then the clients of a great financial advisor should be providers of liquidity in times of (market) crises.

And financial advisors should be providers of sanity by advising their clients to refrain from investing during periods of valuation that are beyond the prices any rational buyer would pay for the whole business.

It is extremely difficult to hold cash (bonds) during bull runs becasue everything you see has doubled or tripled in the last few years during the bull runs.

I have now found another quality to be extremely valuable in the long term:

Trust.

In the long run, the great investor or investment advisor both have one thing in common:

Accumulation of Trust in Society.

I have come to understand that:

- Trust is a rare commodity.

- Trustable People are even rarer.

If I make money through a client but that client does not trust me, the whole transaction is of no use to me.

Inversely, if I don’t make money, but give proper and sane advice to the client and the client “trusts” me, it is immensely more valuable for me.

I have seen many failures in life till date, but I am proud of the fact that I have not broken someone’s trust.

- Never Defaulted on any Debt.

- Never Advised Any Investment for my own Financial Gain.

I have failed to successfully do the task that I was hired to do in my first job. I am ashamed about it till date. But operational failure is a more acceptable type of failure (Type Two Error) as compared to a failure of trust. (Type 1 Error).

If I had to decide one goal for my life, I would want to be on the top of “Most Trustable People” list among my family and friends, in my city, in my state, in my country and worldwide.

Highly trustable people or institutions are often anti-social or lack the ability to make social connections.

This is a tendency I have found to be true.

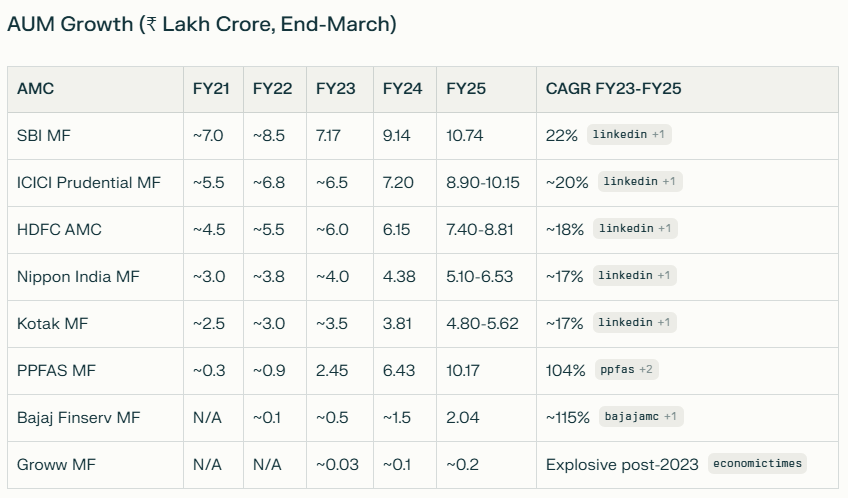

Now let’s look at which Asset Management Companies (Mutual Funds companies) are trustable from my point of view:

- Parag Parikh

- HDFC AMC

- Zerodha Fund House

I have to write another detailed blog post about why I find them to be trustable vs others. Next on the list.

But if look at the actions of these companies:

- They spend minimally on marketing.

- They give minimum financial incentives (commission) to distributors to sell their products.

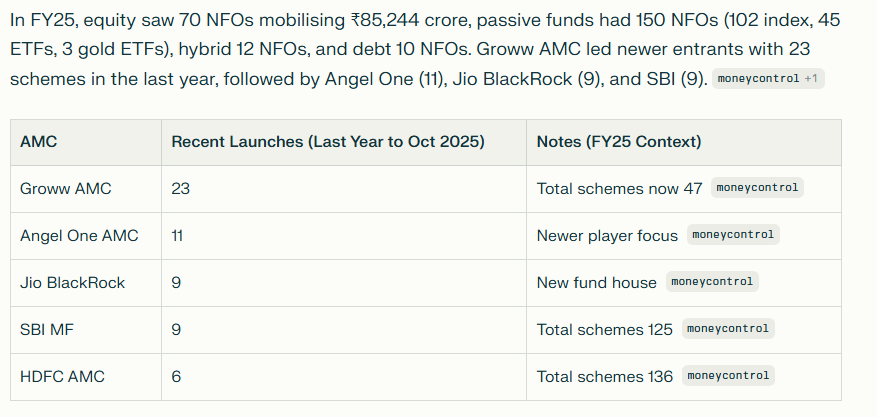

- They launch minimum number schemes which otherwise can be used to take advantage of people who believe in IPO (NFO) investing.

- Every new scheme launch can pay upto 2 to 3 times more commission to distributors compared to already existing and large schemes.

- Financial advisors who like to take financial advantage of their clients are the first ones to Sell NFOs or Sell the funds of New Fund Houses like Bajaj, Navi, etc. Because new fund houses have an incentive to pay very high commissions until they establish themselves in the market.

In the long run, Money accumulates to the trust-worthy.

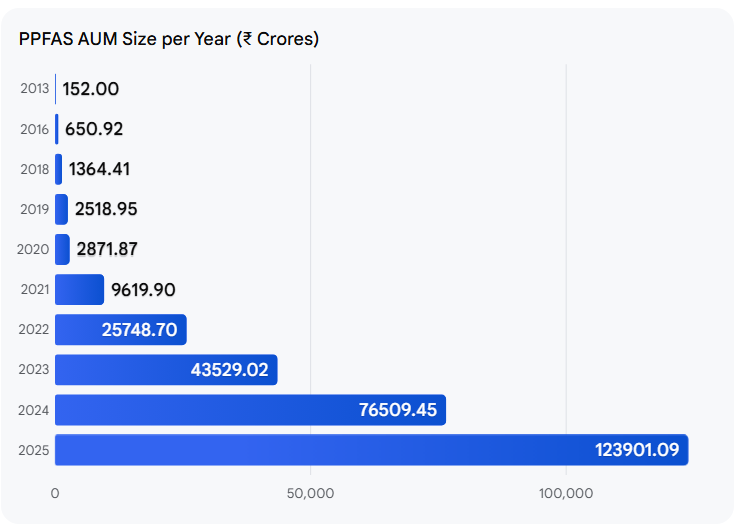

For example, if you look at Parag Parikh Flexi Cap Fund, as of today (5th December 2025), it has around 1,25,000 crores of funds under management.

In the next few year as the bull run slows down and high return mutual funds start disappearing from the market, I would not be surprised if PP Flexicap Fund will double or triple the AUM in the next 5 years after a small fall due to withdrawal by people.

(This is not a statement about the fund’s ability to generate superior returns but about the fund’s ability to attract new capital to the fund when everyone else will be running away from Equity).

Because Trust is the Social Equivalent of Interest in Finance.

Trust Compounds Socially like Interest compounds in the world of finance and investing. [interest = capital gains for taxation purposes 😉 ]

These are the reasons why companies like PPFAS or HDFC AMC made a lot less money (through social tricks) in the last 5 years bull run (as Asset Management Fees) compared to their “very social” peers.

Their social peers like SBI AMC and Groww AMC launched a shit ton of new Funds in the last 5 years.

This helped bad financial advisors make a lot of money at the expense of bad return outcomes for their clients.

But still, PPFAS managed to increase it’s AUM without any new NFOs at a rate similar or faster than it’s peers.

At PPFAS, there is no special team to negotiate commission rates with “big” Mutual Fund Distributors. They don’t spend any money on it.

PPFAS has a fixed commission structure for all distributors, however big or small the distributor may be.

In the next 5 years, as people start seeing lower returns everywhere, they will start leaving and selling all their mutual fund holdings and during those times, “trustable” institutions like PPFAS or Zerodha Fund House will actually see an net inflow of AUM while everyone else will see a net outflow.

So coming back to the question of trust:

- Trust is rare.

- Trust is anti-social. (because if I am good at my work (generating returns), I don’t need to be good at pleasing people and I don’t have the bandwidth (brain power) to please people as well.)

So if you were to breakdown AMC profits or AUM growth into two parts for the last 5 years, you can divide it into 2 parts:

- Profits Due to Returns Generated

- Profits Due to Social Tricks (Marketing Tricks).

We can conclude that PPFAS generated all it’s profits because of point 1 and 0 because of point 2.

How? Because 0 new funds launched and 0 change in commission policy.

And so on.

In the Investment Industry, we breakdown returns into:

- Returns Due to Asset Allocation (Equity, Fixed Income, Real Estate)

- Returns Due to Security Selection (Specific Equity, Specific Real Estate, etc)

This new measure of AUM Growth Breakdown discussed above now becomes necessary to assess the quality of the Asset Management Company.

Final Thoughts

In the end:

After 5, 10, 20 and 50 years, will the society value a person who has sound ability and proven track record of keeping money safe and growing it at rates a little above inflation?

I think the answer is Yes.

Over the long run survival is more important than rate of returns, especially in the business of money and investment.

And in the end, will it be more valuable for me to have 100 crores in my bank vs. having 100 friends with 1 crore each in their bank that trust me fully:

For me, I will take both but if forced to choose one the answer is a obviously having 100 friends.

Money is just a social construct and it will hold no value if no one is willing to take your money in exchange of something of real value.

How to identify: trustable funds and trustable people

But there was no way to know which fund house was good 5 years ago, because we hadn’t seen how they would behave in such a bull run.

I have myself had the (mis)fortune to meet and deeply understand the behavior of bad actors in society in the last 5 years.

Upon analysis, the behavior is now obvious:

The breakdown of profits earned by Bad AMCs and Bad People is similar:

Bad AMCs want to maximize their income from social tricks and marketing tricks instead of focusing on generating best returns or making great investments.

Bad People want to maximize their income without doing any actual work or by designing ways to steal from other people OR trick other people.

Abraham Lincoln once said

You Can Fool Some people all the time and all of the people for some time, but you cannot fool all the people, all the time.

Bad people and bad AMCs will be happy fooling some people (often poor people) for the large portion of their lives.

They will still make a good living out of this.

But it is difficult to grow larger and survive on a national or international scale if you intend to do it by playing tricks or fooling people.

This understanding over the last 5 years has made me adopt a Evolutionary Biology based decision making framework in my life:

If you start looking at things from an evolutionary perspective, it is very easy to separate the milk from the water just by looking at it carefully!

I used to think and believe that all people are equal and therefore everyone is equally valuable and therefore everyone’s idea and opinions should get same value as someone else.

But what a utterly wrong way to navigate through life it was.

Now I understand that people who work hard and actually do what they say are enormously more valuable than someone whose sole purpose in life is to trick and steal from people.

Now if you think from biological evolution point of view:

- You will automatically start differentiating between people who have a track record of consistent action towards meaningful goals vs. people whose track record shows consistent growth in their ability to steal and fool people. (historical performance)

- You will differentiate between people and companies who use all means possible to make progress in the extreme short term or try to get rich quick (high levels of debt, IPO during bull runs)

- You will differentiate on the basis talkers vs doers.

Trustable people generally stick to ultra low margin businesses because it is difficult to comprehend buying something for Rs. 1 and selling it for Rs. 10 while calling oneself trustable or someone who does not deceive people.

But the real world is such that, it does pay 100% to 1000% margins for industries where the decision to purchase is based on emotion rather than logic.

And bad people are very good at finding these industries.

But if you see bad people taking advantage of people and not do anything about it, how good of a person are you?

Therefore entering a high margin business itself is not an act of fraudulence.

By that standard, all the doctors and lawyers and highly paid professionals would be bad people. But they are not.

They are maximizing the Rupee Value Per Minute or Rupee Value Per Hour of their work. And we should all strive to do that.

You can still enter a business with very high margins and provide maximum value to your customers compared to your competitors and still make a lot of money.

In one sense, Amazon did this. They entered a business which was known to be very high margin and vanished the margins away while creating a lot of surplus for their customers.

Jeff Bezoz is famous for saying: “Your margin is my opportunity”.

Now in the retail industry, the high margins are all for high quality of the product and no high margins for being a socially manipulative shopkeeper.

Similarly, Zerodha has saved it’s customers lakhs and lakhs of Rupees (per customer) by making the industry change from a % brokerage to a flat fee brokerage structure.

Meesho is a business model that reminded Amazon India of their own founder’s quote:

“Your margin is my opportunity”

High Margins can only be sustained in the long run because of 3 things:

- Emotional Purchase

- High Trust Purchase

- Monopoly

- Regulation based Monopoly (Government / Political Backing)

- People have no other option

- Work based Monopoly. (most difficult to create).

- outperforming competitors by the sheer amount or volume of work you do. (Very difficult to find or create such businesses).

- Y Combinator?

- sheer volume of work does not always result into monopoly, you have to decide in advance that you want to become a monopoly and iterate from your learnings from the volume of work you do.

- outperforming competitors by the sheer amount or volume of work you do. (Very difficult to find or create such businesses).

- Regulation based Monopoly (Government / Political Backing)